Even with billions of dollars allocated for stimulus programs, the government’s response confused many business owners as they struggled to survive. Nearly 8 million small businesses applied to the Economic Injury Disaster Loan program (EIDL) when introduced in March, but many applicants did not hear back until months later. If you considered a government loan, you’re assuming a long wait time, unpredictable loan approval time, with limited loan amount and eligibility. In this financial climate, startups and entrepreneurs are seeking funding through some non-traditional methods and are turning to FinTech innovations.

with billions of dollars allocated for stimulus programs, the government’s response confused many business owners as they struggled to survive. Nearly 8 million small businesses applied to the Economic Injury Disaster Loan program (EIDL) when introduced in March, but many applicants did not hear back until months later. If you considered a government loan, you’re assuming a long wait time, unpredictable loan approval time, with limited loan amount and eligibility. In this financial climate, startups and entrepreneurs are seeking funding through some non-traditional methods and are turning to FinTech innovations.

Addressing the rise of financial technology (FinTech) innovation and the future of banking, Stanford Law School explained that “…fintech innovation is changing customers’ experience and expectations by promoting a more client-centric and interactive approach to financial and banking services. In addition, recent developments in fintech offer new opportunities for client value creation by enabling smarter understanding of clients’ needs and the design of new personalized products and services.”

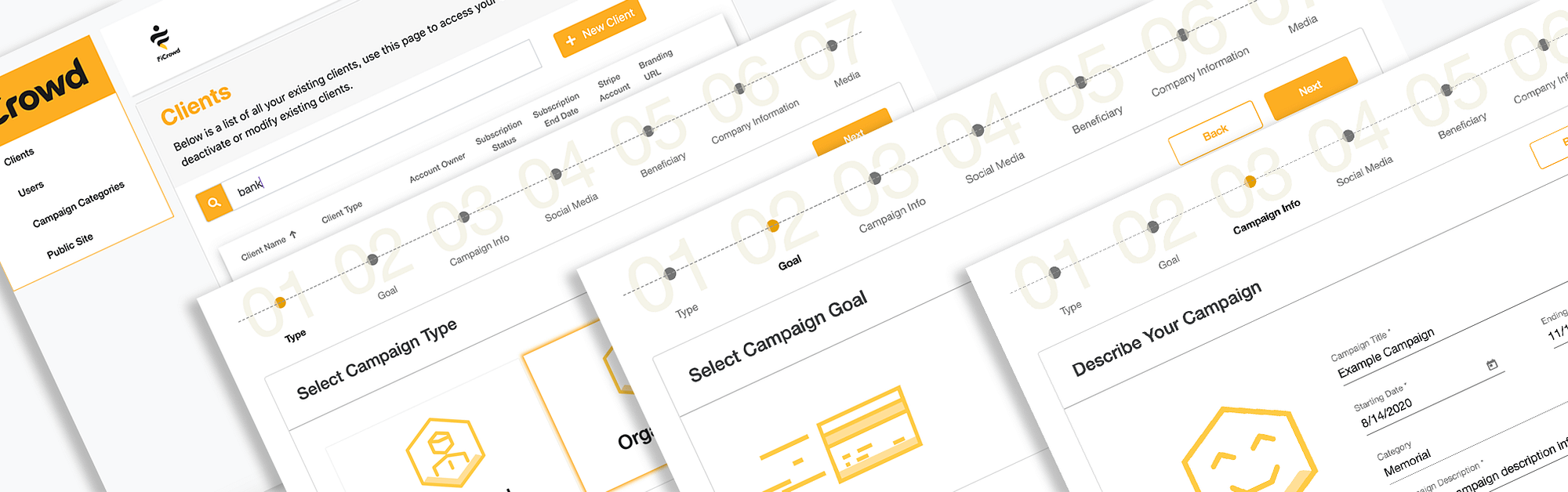

FiCrowd is fulfilling that need with a client-centric and interactive application. Crowdfunding can be traced back to the 1700’s, but this is the first time financial institutions can catalyze meaningful positive change in their communities. FiCrowd, a crowdfunding solution for banks and credit unions based in Indiana, is the first to help financial institutions connected to their community in this digital age. While the idea of crowdfunding isn’t new, its use as a catalyst for meaningful, positive community change is. FiCrowd’s simple platform allows financial institutions to connect with their members, respond to community needs and launch initiatives quickly.

And the FiCrowd solution is simple. Institutions don’t need to open new accounts or allow connections to their core. Members are able to build campaigns in minutes and control the crowdfunding operations. Unlike other technology solutions, FiCrowd has designed their solution to be turnkey with custom branded sites and minimal setup time.

FiCrowd approached Rivers Agile with their project vision. While they knew exactly what they wanted to build, they needed the engineering talent to bring it to fruition. Through the Rivers Agile Workshop program, the FiCrowd team was provided with a full scrum workforce including a Project Manager, UX/UI, Software Engineers, and Quality Assurance Engineers that worked cross-functionally to deliver on all aspects of the Software Development Life Cycle (SDLC). FiCrowd started with descriptions of initial functionality and the Product Managers at Rivers Agile worked to decompose those requirements into individual vertical slices of functionality. As such, Rivers Agile is currently building the FiCrowd Minimum Viable Product (MVP) and doing so on-time, on-budget, with a minimum risk of software defect.

Rivers Agile Founder and CEO, Ben Wilson remarked, “It’s a forward leaning software idea and addresses a long-term problem within the financial space. Everyone is being affected by COVID-19 restrictions, and FiCrowd offers an innovative solution at a time when it’s most needed. We’re very excited to have FiCrowd come through our Workshop.” He added, “It’s not enough to just have a great idea, a successful startup must have great leadership as well. After understanding the FiCrowd vision and working with their leadership team, it was an easy decision to add FiCrowd to our portfolio.”

FiCrowd is a great example of the startups utilizing the Rivers Agile Workshop business acceleration service. The Workshop is designed specifically for entrepreneurs and startups focused on Machine Learning, Financial Technology (FinTech), and Artificial Intelligence (AI). Primarily intended for early-stage companies that generate impact through technology and consumer-focused innovation to trigger growth in preparation for continuing investment. This recent development rejuvenates FiCrowd’s work to keep financial institutions connected to their community in this digital age through crowdfunding.

Learn more about FiCrowd

FiCrowd provides a white-labeled application to financial institutions accessible through a website and customized to any bank or credit union’s branding. FiCrowd gives financial institutions the opportunity to resonate with existing and new customers and members. Drive new deposits, create digital awareness through social channels and utilize data to cross-sell new banking opportunities while helping communities. To learn more about FiCrowd’s suite of products, visit their website.

Learn more about our Workshop

The Rivers Agile Workshop is fostering innovation through personalized investment. This business acceleration service is designed for entrepreneurs and startups focused on Machine Learning, Financial Technology (FinTech), and Artificial Intelligence (AI). Applications are currently being accepted for early-stage technology innovations seeking to trigger growth in preparation for continuing investment. The Rivers Agile Workshop initiative provides support to develop emerging commercially-viable businesses to become attractive to other funders and/or generate revenue. The Workshop’s goal is to transform business concepts into re-fundable startups that generate positive returns and outcomes through their innovation. To learn more about the Rivers Agile Workshop program, visit our Workshop page.